Reprinted with permission of the Idaho Freedom Foundation

Government is an overachiever in collecting taxes on nearly everything we do. It’s hard to imagine anything in our everyday lives not attached to some sort of tax. We are taxed for our food, our homes, our property, our cars, our purchases, our earnings, our investments, and even our deaths.

It doesn’t have to stay this way. Idaho could — and should — eliminate taxes on everyday food purchases. The Legislature and Gov. Brad Little have been promising such a move for years. Recall back in 2017, the Legislature passed grocery tax repeal, but then-Gov. Butch Otter vetoed it.

Later, in his 2018 campaign and subsequent years in office, Little said he supported repealing the tax on groceries and even promised it for 2020.

Yet, still nothing; so Idaho families wait and pay. Now, with President Joe Biden’s inflation and housing costs going through the roof, perhaps it’s time to finally get it done.

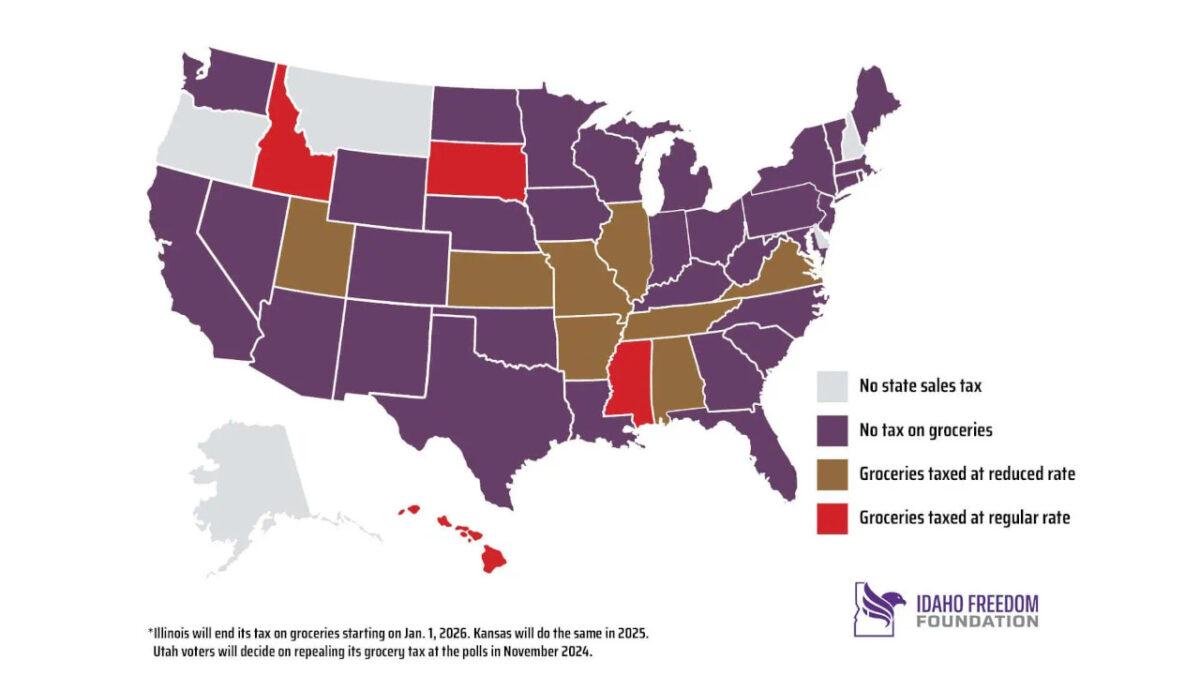

Only four states fully tax their citizens on grocery purchases. Among them, only one state, Mississippi, taxes them at a higher rate than Idaho. In the last four years, inflation has easily exceeded 23%. Isn’t it about time the Legislature does something to help families endure the Biden economy?

In the most recent Annual Statewide Survey poll by Boise State University, 74% of Idahoans asked said inflation and the cost of living were their top economic concerns. Back in 2018, when BSU asked whether Idahoans favored income tax cuts or grocery tax repeal, it wasn’t close. More than twice as many wanted grocery tax repeal (59%) over income tax cuts (28.1%).

This coming January, several legislators will be introducing a comprehensive bill to bring Idaho in sync with 38 other states by exempting sales taxes on grocery purchases. Idaho families deserve the relief because it doesn’t make sense to be taxed on the necessities for living. Grocery tax repeal would restore fairness and efficiency to Idaho’s tax structure.

Worried about the government having enough? Do not fear; the budget impacts from the elimination of the grocery tax would reduce tax collections by some $350 million. This amounts to just 4% of projected state government spending, excluding federal dollars, for Fiscal Year 2025. Certainly, the Idaho government — which has had its budget grow by 53% in the last five years — can afford to forgo 4% of its bloated budget going forward.

Worried about families having enough to live on? The grocery tax puts an undue burden on families by making the necessities of life more expensive. According to the US Dept. of Agriculture, the 2024 monthly estimates for a moderate food budget for a family of four would be $1,182. For the year, repealing the grocery tax would save this family $851. Ask any Idaho family if $851 would help them get by this year, or if the government needs their money more than they do.

Beyond helping families, the grocery tax repeal bill is very important to Idaho businesses too, especially those in our border communities. Many Idahoans flood to neighboring states to buy food. They take their money elsewhere because none of our neighboring states fully tax food: Oregon, Wyoming, Montana, Nevada, and Washington don’t tax groceries at all, and Utah taxes them only at 1.75%. Idaho grocers near state borders will benefit from repeal.

The grocery tax credit system is clunky and makes little sense because it requires people to pay sales tax on groceries throughout the year and then file income tax forms to get some of their money back — not a good policy.

Families are essentially giving the government an interest-free loan for up to a year while food prices skyrocket. Even worse, the credit is a fixed amount; it’s not the actual tax payment coming back. Some families’ credits are lower than their grocery tax payments and others get credits greater than what they paid. It’s simply not fair.

We should consider low-income families, too. Many of them, currently on food stamps, don’t pay taxes because food bought with federal aid is not taxed. So, in our grocery tax system, the working poor who are not on food stamps are at a disadvantage relative to those on food stamps because they must pay taxes on groceries, and then wait on the government for a tax refund. Again, this is not fair.

The clunky grocery credit system requires the elderly and those who don’t normally file income tax forms, to file tax forms for the sole purpose of getting the credit. Many of them are unaware and never get the credit because they don’t file for it. It would have been better for all if they never had to pay the tax to begin with.

Idaho, typically seen as the beacon of freedom in the country, is miles behind the rest of the country in how it protects families from burdensome taxes on their grocery necessities. Perhaps 2025 is the year Idaho finally catches up. Idaho families certainly feel the pain of inflation. Will they finally get the relief their neighboring states have enjoyed for years?

One reply on “It’s time to axe the tax on groceries in Idaho”

THINKING TOO SMALL!

It’s way past time to axe every single one of the Constitutional Republic’s unbiblical taxes throughout all of America.

Just think: Had the constitutional framers (like their early 1600’s predecessors) established government and society upon the Bible’s immutable/unchanging moral law (including its economic and taxing statutes), there would be no graduated income tax, no property tax, no sales tax, no grocery tax, nor any of the other sundry unbiblical taxes.

There would, furthermore, be no Federal Reserve, nor its mistress today’s usurious fiat banking system, nor its enforcement arm the Internal Revenue Service.

For more on how the Bible’s integral triune moral law (the Ten Commandments and their respective statutes and judgments) applies and should be implemented today as the law of the land, see free online book “Law and Kingdom: Their Relevance Under the New Covenant” at http://www.bibleversusconstitution.org/law-kingdomFrame.html

See also Chapter 25 “Amendment 16: Graduated Income Tax vs. Flat Increase Tax” of free online book “Bible Law vs. the United States Constitution: The Christian Perspective” at https://www.bibleversusconstitution.org/BlvcOnline/biblelaw-constitutionalism-pt25.html