It appears that signing any tax bill coming out of this Congress should be called not a deal, but a fake deal! If so, the GOP will commit political suicide. It’s doubtful that the tax bill will be successful with Mitch McConnell running the show. He is an establishment obstructionist, can’t be trusted and must be removed!

No one understands how anxious President Trump is on his important campaign promise of delivering ‘effective’ lower taxes than the swamp dwellers in Congress, including both parties in both houses, particularly the shadowy establishment’s ‘Never Trumper’ GOP leadership.

Both house speaker Ryan and Senate leader McConnell are masters of control and I expect them both to manipulate with various justifications for an ultimate bill of consensus that will pale compared to what Trump campaigned on and my worry is that President Trump is actually yearning so much for closure he will take what he can get and call it a deal, even if it’s close to being lipstick on a pig.

Neil Cavuto at Fox News says treasury secretary Steve Mnuchin’s tone on the tax bill is just disastrous, he is a horrible marketer for this horrific plan. Cavuto says the plan is beyond a joke and it is beyond incomprehensible how they are taking what should be an easy run into the end zone and turning into an interception. He says he cannot fathom it and it is all unraveling right before our eyes. McConnell’s Senate bill is reported to actually keep in place some of the key overt things that are in the House bill, some of the changes might come in phases and the 20% corporate tax rate will be postponed for a year, in 2019.

If that corporate tax rate should be postponed, it is probable that the democrats will return to power and then vote no.

McConnell’s favorite justification tool for all things obstructing seems to be the Office of Management and Budget that has been called corrupt and dishonest for a long time and even Newt Gingrich says of it “I don’t trust a single word they have published. And I don’t believe them.” Also see: “Congress’s Official Scorekeeper Just Delivered a Damning Assessment of the Republican Tax Plan”

Paul Ryan answered Rush Limbaugh’s concern about having heard that Republicans will secretly raise tax rates not long after tax rates are cut. Limbaugh heard that supposedly in about five years some of these new rates will automatically increase, but that’s not being discussed, admitted to or reported on under the guise that the whole thing has to be paid for.

Ryan answered that there is to be a sunset in five years for some provisions that are never ever intended to be removed which includes some of the business expensing provisions and the personal credit for non-children, like taking care of parents. He said the reason they did that is to conform with the budget rules so that they can make sure this thing cannot be filibustered in the Senate. However, in the house, unfortunately, they have to work with the rules that the Senate has, so this thing cannot be filibustered. Ryan said that that’s why that’s there. “It’s a sunset that will never occur and we never intend it to occur. This is something that Congress actually does on a regular basis. The point being, it’s just to conform with the budget rules so that this thing cannot be filibustered in the Senate.”

I guess we feel better now, right?

HOW IS THE GOP TAX BILL SO FAR?

Bob Adelmann reports in his article ‘What’s in the GOP Tax Bill?’ that already where the bill appears to have three tax brackets it really has six brackets down from seven.

He states: “First, the bill appears to offer three tax brackets instead of seven: 12 percent, 25 percent, and 35 percent. But those on the lowest steps of the income ladder technically won’t pay anything, as nearly half of working Americans don’t pay any net federal income taxes because they receive more in government benefits or refunds than they pay in, so they effectively are in a “zero-percent” tax bracket. And the GOP has acceded to demands by Democrats to leave the present highest tax bracket alone: 39.6 percent. So that essentially makes five brackets.

“But wait, there’s more! The day after the GOP plan was rolled out, House Ways and Means Committee Chairman Kevin Brady (R-Texas) added a “bubble tax” for those with incomes over $1 million a year. That brings the 39.6 percent bracket to 46 percent and change. So that’s six brackets, down from the current seven.

“Of course, typical of how Washington works, what the GOP presented on Thursday, Nov. 2nd will look nothing at all like what is finally passed by the House, and that will look little like what the Senate, and the conference committees following, will present to President Trump for signing.”

For more on the “bubble tax” read: “Bubble Tax”: The GOP’s Hidden 46% Tax Bracket

Adelmann also reports, that the “Democrats will work to scuttle any attempt to relieve fiscal pressure on entrepreneurs (i.e., capitalists) who are largely carrying the burden of supporting the government. Absent any attempt to cut spending — the tax bill’s 429 pages offer little help with that — what’s left, as has been said, is simply moving the chairs around on the deck of the Titanic.”

And now the Senate version of this tax bill calls for seven tax brackets. Wonderful. Goodbye GOP in the next election.

GOP TAX PLAN INCREASES THE MOST INSIDIOUS TAX

“The Republican tax cut plan has some positive elements, such as increasing the standard deduction, creating a new family tax credit, eliminating the death tax, reducing the corporate tax rate, and lowering taxes on small businesses. It also has some flaws, such as the “millionaire surcharge” imposed on upper-income taxpayers. This provision reflects a belief that upper-income taxpayers only “deserve” a tax break if reducing their taxes serves the interest of government by increasing economic growth.

“The Republican tax cut plan has some positive elements, such as increasing the standard deduction, creating a new family tax credit, eliminating the death tax, reducing the corporate tax rate, and lowering taxes on small businesses. It also has some flaws, such as the “millionaire surcharge” imposed on upper-income taxpayers. This provision reflects a belief that upper-income taxpayers only “deserve” a tax break if reducing their taxes serves the interest of government by increasing economic growth.

“The worst part of the tax plan is that it adopts the chained consumer price index (chained CPI). Chained CPI is a way of measuring CPI that understates inflation’s effects on our standard of living. It does this by assuming inflation has not reduced Americans’ standard of living if, for example, people can buy hamburgers when they can no longer afford steak. This so-called full substitution ignores the fact that if individuals viewed hamburgers as a full substitute for steak they would have bought hamburgers before Fed-created inflation made steak unaffordable.

“Chained CPI increases the inflation tax. The inflation tax may be the worst of all taxes because it is hidden and regressive. The inflation tax is not even a tax on real wages. Instead, it is a tax on the illusionary gains in income caused by inflation. The use of chained CPI to adjust tax brackets pushes individuals into higher tax brackets over time.

“Politicians love the inflation tax because it allows them to increase taxes without having to vote for higher rates. Instead, the Fed does the dirty work. Since their creation in 1913, the Federal Reserve and the income tax have both enabled the growth of the welfare-warfare state and the erosion of our freedom and economic well-being. The key to restoring our liberty and prosperity, as well as avoiding a major economic crisis, is reversing the great mistakes of 1913 by repealing the 16th Amendment and auditing and ending the Federal Reserve.” – Unquote former U.S. congressman Ron Paul in his article “GOP Tax Plan Increases The Most Insidious Tax”

A DEAL ISN’T A ‘DEAL’ IF IT IS A BAD DEAL

Neil Cavuto also says that tax cuts are ultimately bought or not bought, sold or not sold in the stock market on the idea that they are going to result in more net for individuals and or companies. He says, “A lot of the tax cuts that are proposed now are geared to people that don’t pay income taxes and the overwhelming share that do pay a lot, get no relief at all. That can’t be lost on people. Whatever boost these folks are going to get, it will be short lived.”

Cavuto repeated that the GOP is bragging about middle-class taxpayers filling out their complete tax returns on an index card and saying ‘You’re going to love it.’ He then said, “Do you know what I think they are going to love more? Paying less in taxes. They wouldn’t care if they had to fill out 500 pages, if they can pay less.”

He said he asked some of his younger employees that question [whether they would rather have an index card to fill out and not get much back or a much greater amount of paperwork but get a lot more back] and they all chose the latter.

Charlie Gasparino at Fox News says he thinks if you got together Steve Moore, Larry Kudlow and Art Laffer, the three market-oriented supply-sider economists who came up with the original Trump plan, and they were being honest with you, they would say do nothing before doing this crap. Gasparino says that Congress is making the tax bill worse, they are making the tax code more complicated for people that pay most of the taxes.

Gasparino made the strong point that we have to hold President Trump’s feet to the fire on this, and Congress, both of them. Because they are both saying that they are enacting a huge tax cut and patting themselves on the back by giving middle-class people a tax cut when in fact middle-class people don’t pay a lot in federal income tax.

“An average guy that makes 50 to 75 grand, it’s great to say we’ll give you a tax cut and you’ll only have to fill out one sheet. Those are the people that don’t have the complicated tax maneuvers. If you want to cut taxes for average folks, cut the payroll tax. That would be big, this is a joke,” says Gasparino.

Americans don’t want window dressing they want accountable real results that measures up to campaign promises. Tax rates alone mean nothing. Effective rates, or the rate we actually pay in taxes after all deductions, are what we should strive for. All the manipulations with deductions, write-offs, tax credits and the such are what game our system and allow extremely wealthy individuals and large corporations in high tax brackets to wind up paying effectively very little and even nothing. Do you remember the report about Warren Buffet’s secretary paying more in taxes than he does? And where is the repeal of the ObamaCare individual mandate?

THE EPITOME OF HOW BAD OUR TAX SYSTEM IS

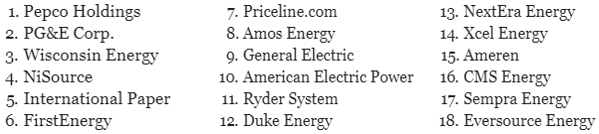

In her article ‘Meet the 18 profitable companies that paid no taxes over 8 years,’ Moneywatch’s Aimee Picchi reports: “But thanks to loopholes and tax-minimization strategies, few large, profitable corporations actually pay that rate. Among the roughly half of Fortune 500 companies that were consistently profitable between 2008 and 2015, the effective federal income tax rate was 21.2 percent over that eight-year period, according to a study from the Institute on Taxation and Economic Policy. Eighteen of them, including General Electric (GE) and Priceline.com (PCLN), paid no federal income taxes during that time.” Below are the 18 companies that paid no federal income tax from 2008-2015, according to ITEP. Many of them are in the energy sector.

And USA Today’s Matt Krantz in his article ’27 Giant Profitable Companies Paid No Taxes’ says, “There are 27 companies in the Standard & Poor’s 500, including telecom firm Level 3 Communications (LVLT), airline United Continental (UAL) and automaker General Motors (GM), that reported paying no income tax expense in 2015 despite reporting pre-tax profits, according to a USA TODAY analysis of data from S&P Global Market Intelligence.”

So there you have it. Tax rates are not the subject we should be talking about. We should be talking about effective tax rates. In other words, if we want to stick it to the really rich, take away the credits, deductions, and write-offs etc.

All these special interest considerations are endless manipulating and people aren’t stupid, in fact, they are fed up with being taken for granted. Americans see through the maze and know that the end effective rate is what taxes should be about. Things run best and most smoothly when they run most simply.

All these special interest considerations are endless manipulating and people aren’t stupid, in fact, they are fed up with being taken for granted. Americans see through the maze and know that the end effective rate is what taxes should be about. Things run best and most smoothly when they run most simply.

Tax law should be about effective tax rate percentages. We need President Trump to be thoroughly aware of what a tax ‘deal’ fully entails because he is dealing with venomous snakes from our national swamp.

CONGRESS TODAY

This progressive bunch of today’s democrats spewing all their rabid socialism could literally be likened to the devil in their current state of being. I’ve occasionally stated that going across the aisle to make a deal with the devil is still evil. Like former Democrat GA Governor and U.S. senator Zell Miller said, he didn’t leave the Democrat Party, they left him. The Dimm’s have morphed into a deceitful endeavor to outright change our system into a socialist society. Can you say Cuba & Venezuela?

The RINO’s of the GOP, that’s about 90% of them, aren’t socialists, but they aren’t much better since they simply don’t do what they say they will do. Check their voting records with our Constitution they swore oaths of allegiance to. In this first session of the 115th Congress, the members of the House voted 41% and the Senate 35% with our Constitution.

The best thing to be said for the GOP is that they have a fantastic party platform if only they had the ethical character and patriotism to follow it and the Constitution. They also should pay attention to what President Trump is trying to accomplish and support his agenda because his heart is in the right place for America’s future. He really does want America to be truly great again and for that to happen we need to effect getting our tax system mess cleaned up and establish effective rates that works for our citizens, their states and the states’ national government.

GOING FORWARD

Priorities at present dictate that we accomplish getting these effective rates set to satisfy campaign promises so President Trump can succeed like President Reagan did. When the dust settles and we get to replacing a whole lot of sorry RINO’s and Democrats with patriotic republicans that follow the GOP platform and our Constitution, we need to revisit our tax structure to ‘simplify it’ and eliminate all the special interest deductions, right-off, tax credits, and deferments etc. A lot of oxen need goring. And, in a world of bonafide patriots that follow the Constitution, imagine the tax reductions that could be realized from abolishing all government subsidies, foreign aid, support programs for illegal aliens, redundant government agencies and welfare becoming workfare, just to start with.

All our departures from our Constitution have been endeavors in socialism if we recognize it or not. And socialism has never been successful anywhere in the history of the world! Think Cuba, Venezuela, and even Denmark/Sweden.

“Legal plunder can be committed in an infinite number of ways. Thus we have an infinite number of plans for organizing it: tariffs, protection, benefits, subsidies, encouragements, progressive taxation, public schools, guaranteed jobs, guaranteed profits, minimum wages, a right to relief, a right to the tools of labor, free credit, and so on, and so on. All these plans as a whole — with their common aim of legal plunder — constitute socialism. – Unquote from Frederic Bastiat’s ‘The Law‘