This article is courtesy of the Idaho Freedom Foundation

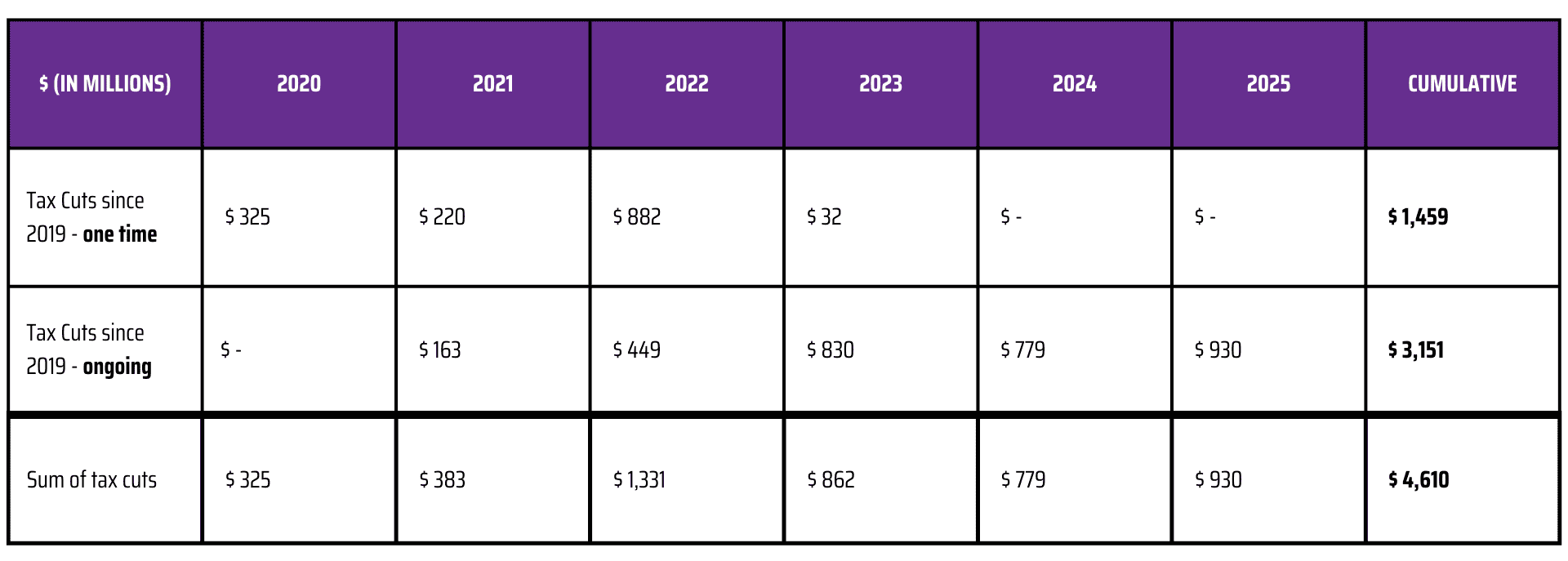

Governor Little recently issued a press release claiming that since assuming office in 2019, his administration cut taxes paid by Idaho residents by $4.6 billion — cumulative through 2025. This figure includes income tax cuts, property tax reductions, one-time rebates, an increase to the grocery credit, a childcare deduction, and a reduction in unemployment taxes.

According to the Governor, approximately two-thirds of the $4.6 billion in cuts are ongoing. The ongoing portion is nearly a billion dollars annually, about a 10% cut from all revenue sources, which includes all major revenues to state and local governments.

Cutting taxes by billions of dollars is a notable achievement both the Governor and the Legislature should be proud of. Now, just to be clear, despite what leftists tell you, tax cuts didn’t lead to starving the government of your money. Tax collections still grew dramatically.

Yes, taxes have been cut dramatically, but had tax revenue growth been limited to inflation plus population growth, we could have eliminated property taxes over the past decade. Let’s see how.

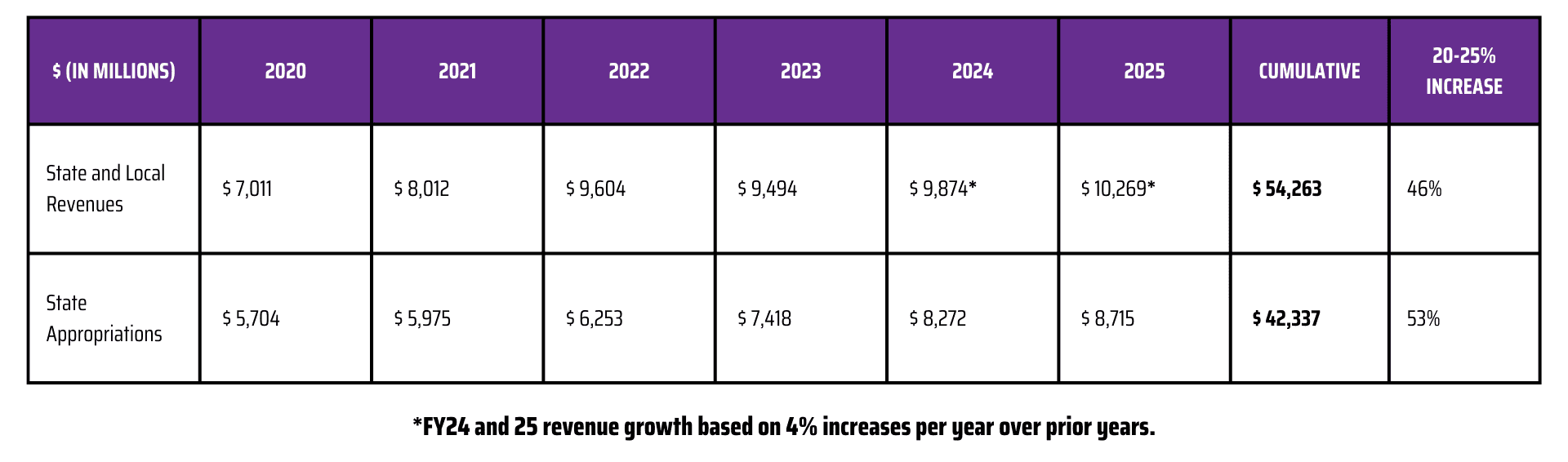

Total tax collections to state and local governments have increased from $6.5 billion in 2019 to $9.5 billion in 2023, the last year for comprehensive data. That’s over 2.5 times the increase in the consumer price index, the most common measure of inflation. And yes, the population has increased about 8% over the same period, so when we add inflation to population, it sums to about 26%.

Yet even with the tax cuts, total tax collections are up 46%. These are differences that matter: tax collections are nearly double what inflation and population growth would dictate.

If you are following the math, one logical question is, what would tax collections have been in 2023 if total tax growth had been held to a 26% increase from 2019 to 2023? The answer is about $8.2 billion, or about $1.3 billion lower than the $9.5 billion it was in 2023. To put that into perspective, the total property tax revenues in 2023 were $2.2 billion.

Limiting tax collections to population plus inflation over a four-year period would have cut enough spending to allow Idaho to eliminate about 60% of property taxes!

But Idaho did not limit its taxing or spending, so where did the extra money go? Well, I think that you know the answer. It was either spent or allocated to government reserve accounts. For example if you review the total state appropriations (excluding federal funds, county and local expenditures), they were $5.4 billion in Fiscal Year 2019 (FY19) and increased to $7.4 billion in FY23, an increase of 37%.

Had state appropriations been held to a 26% increase in line with population growth plus inflation, the spending would have been about $6.8 billion, leaving $600 million on the table to help reduce the property tax! And don’t forget, you have to add to that number the county and local government spending increase over the cumulative 26% (detailed summary data for 44 counties and all cities are not available for a direct comparison).

How could all this have worked differently? Well just as an example, in FY23 over $300 million in sales tax revenue was provided to county and local governments. There is nothing sacrosanct about this amount. Sales taxes pulled in over $3 billion in FY23. Had less money been spent on state appropriations, some of the extra sales tax revenue could have been used to displace property taxes. But this only works if spending growth at the state, county, and local levels had been held to inflation growth plus population.

This exercise isn’t an exact policy prescription but rather a rough example to show how ambitious tax relief is possible — including eliminating an entire class of taxes if proper spending restraint had been exercised.

In North Dakota, there is a constitutional initiative on the ballot to eliminate property taxes. The initiative has some weaknesses, but the point is that Idaho could have led out on this idea or at least copied it.

This analysis compared the changes in revenue and spending over only a few years. Extending this analysis to the decade coming out of the financial crisis of 2008-2009, we could have eliminated property taxes entirely. If Idaho had simply restrained spending to inflation plus population growth, then the dream of eliminating property taxes could have been a reality by now. How so? Well, the FY14 state and local revenue collections were $4.9 billion. Grow that by inflation plus population growth until FY23, and revenues would have been $7.2 billion. And that would have been $2.3 billion less than the actual state and local revenues of $9.5 billion. Enough to erase property taxes!

Let’s not allow another decade pass without restraining spending and making the tax cuts necessary to finally liberate Idahoans from the shackles of property taxes. The math is sound, but do the Legislature and Governor have the courage?

2 replies on “A Roadmap for Ending Property Taxes”

BETTER YET – ELIMINATE THE GENESIS OF GOVERNMENT THEFT!

Thanks to Amendment 5’s provision for government confiscations (theft) of private property via eminent domain, property taxes, and public lands, there’s not one square inch of private property that is not now “owned” by federal and state governments alike.

If you think this doesn’t apply to the property you “bought and paid for,” just stop paying your property tax and agents with badges and side arms will eventually show up to escort you off the property of those they represent. Give them enough guff, and they’ll escort you to jail.

In other words, the Constitution hasn’t protected your property, anymore than it has your life, your firearms, etc. Instead the Constitution has been the means of confiscating your property, licensing your firearms, and destroying life, including the millions of infants slaughtered in their mothers’ wombs financed by the Constitutional Republic.

If you’re in anyway a promoter of the biblically seditious Constitution as the law of the land, you’ve been *taken* for ride and you’ve been spurring the “horse” responsible for carrying America to the precipice of moral depravity and destruction.

For more, see Chapter 3 “We the People vs. Yahweh” of free online book “Bible Law vs. the United States Constitution: The Christian Perspective” at https://www.bibleversusconstitution.org/BlvcOnline/blvc-index.html

Then Chapter 14 “Amendment 5: Constitutional vs. Biblical Judicial Protection.”

It’s been nearly 30 years now since Creator God revealed to me the antichrist document the CONstitution was a rejection of God’s Kingship in the land of His creation.

There is absolutely nothing in the CON that is not a rejection of the Creator’s Kingship/Kingdom on Earth as it is in Heaven,

Caleb