But There’s a Lot More to It Than That

This is Part 2 of a three-part series of articles on the student loan crisis. Part 1 provided an introduction to the subject, explored who is to blame, and offered an overview of the process of performing a cost-benefit analysis of college degrees, the jobs they lead to, and the financing of them that every person contemplating attending college should perform before even applying to a college. This part will examine other factors that contributed to the student loan crisis, where we stand now, and what student loans actually accomplished in opposition to what their original purpose was. Part 3 will look at how government is contemplating fixing it and concluding remarks.

What are other contributing factors?

While students must ultimately bear the responsibility for their life choices, there have clearly been significant factors that have set them up for failure. Recall that we assumed for the sake of discussion that the students are adults as they claim. But their opinions do not change reality. The fact is that the average college-aged student is not an adult – at least, not in one critically important way: the prefrontal cortex of their brain is not yet fully developed. The article, “Maturation of the Adolescent Brain” in Neuropsychiatric Disease and Treatment, states the following about development of the prefrontal cortex of the brain:

Recently, investigators have studied various aspects of the maturation process of the prefrontal cortex of adolescents. The prefrontal cortex offers an individual the capacity to exercise good judgment when presented with difficult life situations. The prefrontal cortex, the part of the frontal lobes lying just behind the forehead, is responsible for cognitive analysis, abstract thought, and the moderation of correct behavior in social situations. The prefrontal cortex acquires information from all of the senses and orchestrates thoughts and actions in order to achieve specific goals. The prefrontal cortex is one of the last regions of the brain to reach maturation, which explains why some adolescents exhibit behavioral immaturity. There are several executive functions of the human prefrontal cortex that remain under construction during adolescence… The fact that brain development is not complete until near the age of 25 years refers specifically to the development of the prefrontal cortex.

The article identifies the executive functions of the prefrontal cortex as:

- Ability to balance short-term rewards with long-term goals

- Considering the future and making predictions

- Focusing attention

- Organizing thoughts and problem solving

- Forming strategies and planning

- Inhibiting inappropriate behavior and initiating appropriate behavior

- Simultaneously considering multiple streams of information when faced with complex and challenging information

- Foreseeing and weighing possible consequences of behavior

- Shifting/adjusting behavior when situations change.

- Modulation of intense emotions

- Impulse control and delaying gratification

In other words, ALL of the cognitive functions required for planning and executing the long-term goals associated with a future career and lifestyle are not yet fully developed in college-aged students. While it is critically important for adolescents to have the freedom to take risks, have new experiences, and make social connections, two facts remain: one, their brain is not completely developed, and two, even though they are not wholly lacking these functions, they have little to no experience planning and executing critical, life changing decisions that require planning well into the future.

As with any skill, it takes significant practice to become competent. The role of parents, teachers, counselors, educational institutions, and the government must include an understanding of their responsibility to mentor and guide the adolescent through the minefield of life so that the failures they are allowed to experience are truly learning experiences from which they can benefit rather than catastrophes that have life-long adverse consequences.

It is the skills to recognize the distinction between these two circumstances and the critical thinking tools that must be employed to successfully manage them that are particularly weak in the inexperienced adolescent and with which they need the most guidance. It is, in fact, the failure of the mentors in their lives to provide the necessary skills and guidance that has contributed to student’s inability to responsibly avoid the student loan crisis. As will be shown, the Federal government in particular has set them up to fail through its decision to attempt to artificially increase college enrollment in the misguided belief that it would improve outcomes.

Where we are.

According to the DOE website and a DOE report, since taking over student loans, the Federal government has achieved the following:

- $1.5 trillion in outstanding loans.

- 42 million borrowers.

- The Federal Student Aid (FSA) office is the nation’s largest consumer lender.

- 8 different repayment plans, each with different eligibility requirements.

- 30 deferment options.

- 14 loan forgiveness programs.

- 11 different providers, each with their own websites, phone numbers, and forms.

- Principal and interest are being paid down for only 1 in 4 loans.

- 11 million loans are delinquent or in default.

- 43 percent of all loans are considered ‘in distress’.

- The likelihood that a student loan is mismatched to the chosen career is so high that loans offered have ‘Estimated Loan Forgiveness’ amounts automatically calculated.

- At 53 percent of institutions, more than half of alumni are not even earning more than a typical high school graduate within six years after starting at the school.

Prior to the Federal government guaranteeing student loans, private lenders, in order to ensure they would get their money back, were incentivized to screen applicants, the degree they were seeking, and the career they were intending to pursue. If the applicants were pursuing a degree that lead to a job that could not afford the student loan, the loan would not be granted. After the Federal government started guaranteeing student loans, lenders had no incentive to match loan size with the capability of a degree to carry the loan – the lender would get their money back anyway. The due diligence performed on behalf of the students by the lenders was eliminated. When the Federal government started directly financing these loans, they continued the practice of unlinking the granting of student loans from the ability of the ultimate job to support the loans.

Compounding this problem was the fact that this also eliminated the incentives for colleges and universities to control costs. Students could now get the loans necessary to meet sky-is-the-limit tuitions. Further, the mandate of the Department of Education to increase the use of student loans created a conflict with any effort to see that high schools had courses teaching students how to perform cost-benefit analyses on college degrees. The resulting student loan crisis was not only predictable, it was intentionally designed that way to produce high profits for the lending institutions, the loan servicing industry, and the colleges and universities that had our politicians in their pockets – all under the false excuse that enrollment would be increased and outcomes universally improved. Given the continuance of this policy in the face of the resulting outcomes, the only possible conclusion is that the people, politicians, and institutions behind the student loan program were and are criminally negligent.

What student loans actually accomplished

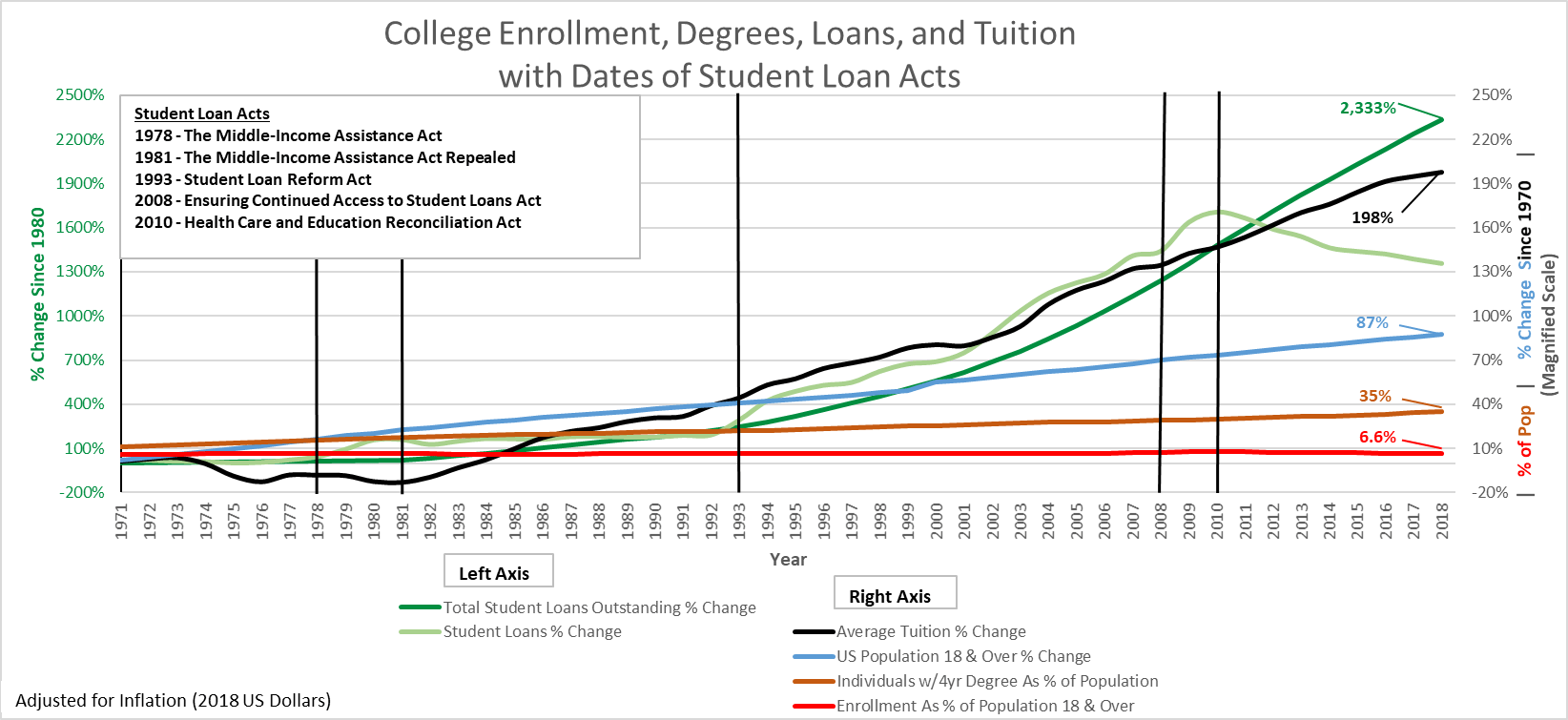

Figure 1 is a chart that brings several important aspects of student loans together in one place. This chart is critical to a full understanding of what has actually been accomplished by student loans – in contrast to what is claimed. The chart shows student loans, tuition, total degrees held, and population as a percentage of change since 1971 by year. Black vertical lines mark when important Federal student loan acts were passed. The scales are color-coded to the plotted lines to clearly show which scale to use for a given line on the chart.

The red line shows student enrollment as a percentage of the US population and is the most telling line on the chart because it tells us if a greater percentage of our population is enrolling in college over time. In other words, has the student loan program been successful in increasing the percentage of our population that attends college? It has not. From 1970 to present, between 5.7% and 7.7% of the population enrolled in college regardless of world events, economic conditions, or, notably, availability of Federally guaranteed student loans. This is astonishing. With $1.6T in outstanding student loans, and a total of over $2.6T in loans issued in the history of the student loan program, the percentage of the population enrolled in college is virtually unchanged from 45 years ago!

By looking at enrollment as a percent of population, the increase due to our increasing population is removed, and only the increase due to other factors like student loans remains. Unfortunately, there are no other factors causing an increase in enrollment – the red line is flat. The idea given lip service by politicians, educators, and student loan financial leaders that student loans make college available to a larger segment of the population is revealed as a complete fabrication. More students than ever before are attending college only because our population is larger than ever before – on average, after spending $2.6T, the same 6.5 percent of the population are attending college.

Figure 1: Historical College Enrollment, Degrees, Loans, and Tuition

Chart: Klammer

Data Sources: https://www.statista.com/statistics/183995/us-college-enrollment-and-projections-in-public-and-private-institutions/; https://college-education.procon.org/history-of-college-education/; https://www.statista.com/statistics/238109/tuition-and-fees-in-the-us/; https://www.cnbc.com/2017/11/29/how-much-college-tuition-has-increased-from-1988-to-2018.html; https://college-education.procon.org/history-of-college-education/; https://nces.ed.gov/programs/digest/d07/tables/dt07_320.asp; https://research.collegeboard.org/trends/student-aid/figures-tables/total-student-aid-and-nonfederal-loans-over-time;https://www.savingforcollege.com/article/history-of-student-loans-origins, https://fred.stlouisfed.org/series/POPTOTUSA647NWDB#0

As the dark green line shows us, Federal student loans had a huge increase that started in 1992, but it had absolutely no effect on the percentage of the population 18 years and older that enrolled in college (red line). This indicates that the availability and even the use of student loans does not encourage students, who previously were not planning to attend college, to attend college because those additional students would have caused an increase in the enrollment rate. What actually happens, is that a greater number of students who were going to attend college anyway found it necessary to use Federal student loans instead of some other means of paying for college due to the out of control cost increases brought on by the student loan program itself.

The CATO Institute article, “Inventing a Student Loan Crisis” states:

Indeed, it’s the vicious cost‐escalation cycle that has made loans increasingly important: students and parents complain that higher education is too expensive, vote‐seeking politicians increase grant and loan aid, colleges raise tuition to gather the new money, students and parents complain again, and around we go.

That this cost-escalation cycle and the associated transfer of student loan funds is intentional is borne out by the fact that the free flow of student loans continues even when the lives of 48% of the students receiving the loans are ruined by them rather than enhanced. The article continues with the statement:

Taxpayers bear the biggest burden of these expenditures and reap little to none of the educational rewards. Over the last ten years, students’ real, after‐aid educational costs — tuition, fees, room and board — increased approximately 24 percent at private four‐year colleges, and 35 percent at public institutions. Federal aid furnished by taxpayers, meanwhile, increased much faster, rising 77 percent in the last decade, from $48.7 billion to $86.3 billion.

The black line on the chart shows that college tuition alone (not including room, meals, etc.) has sky-rocketed in an out of control straight line by 198% since 1970 (adjusted for inflation). The fact that student loans increased at a rate over ten times faster than college costs with no increase in the percentage of the population enrolling in college is further evidence that the promotion of student loans is not driven by the needs of students.