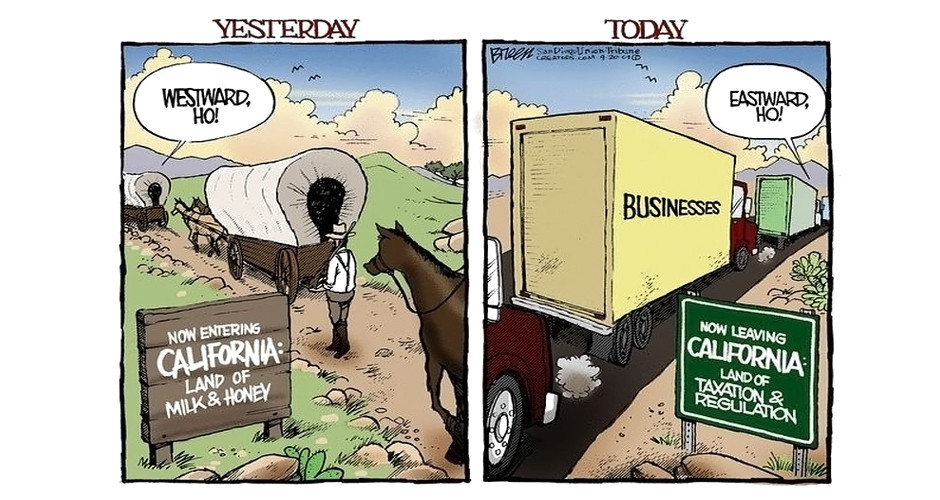

Productive, tax-paying citizens have been escaping from high tax states like California and New York for years. I should know. I’m a refugee from both high tax California and New York. Don’t look now, but President Trump just finished the job.

Say “adios” to California.

President Trump just made it almost impossible for high-income earners and business owners to stay in California and other high tax states. The new Trump tax law will literally put the final nail in the coffins of big tax, big spend, big welfare, big government states like California, New York, New Jersey, Connecticut and Illinois. They are finished. Kaput. Adios.

These states are America’s Greece…Puerto Rico…Venezuela. Bankrupt socialist hell-holes in dramatic decline.

No, I don’t mean that everyone will leave California. The illegal aliens and welfare/food stamp addicts will stay. Why not? They pay no taxes, the welfare checks are generous and the weather is beautiful.

So millions of “takers” with their hands perpetually out will stay. But the “makers” have no choice but to run for their lives. Literally everyone who makes over $250,000 a year will consider leaving California. Everyone who owns a business will consider leaving California. Everyone with a million-dollar mortgage will consider leaving California. Everyone with a $20,000 or higher property tax bill will consider leaving California. There is no choice. The new Trump tax law makes it virtually impossible to stay.

Let’s look at a California entrepreneur, executive or professional earning $1,000,000 a year. They owe about $140,000 a year in state income taxes on that million-dollar income. Plus, I’m betting $50,000 in property taxes on a beautiful home. Add in sales taxes and car registration fees. They are easily paying $200,000 or more to the state of California. But they can only deduct $10,000 from their federal taxes. So, they owe 37% federal tax liability on $200,000 that they already paid in taxes. You do the math. That’s a minimum of $74,000 they now owe Uncle Sam on money they don’t have—because it’s already been stolen by their state. Good luck.

A person could wind up broke really fast in Beverly Hills or Malibu based on those numbers. Citizens of Manhattan or Greenwich or The Miracle Mile of Chicago are in the same situation. I’m talking about people who make $1,000,000 a year. Pity the poor chump who “only” makes $250,000 to $500,000 with 2 kids in private school, a big mortgage and thanks to Obama, health insurance bills of $3,000 per month.

Trust me, the entire high-income, high net worth, business-owning population of California is making plans to leave TODAY. These are the crème de la crème. These are the people who pay almost all the taxes and create all the jobs. They pay into the system and take nothing out. Any state would die to get these taxpayers.

This group has to escape. Even $500,000 to $1,000,000 a year income earners will go broke fast. They can stay of course. It’s possible to live in California or NY on $500,000 to $1,000,000 a year—if you give up your Porsche, nanny, personal trainer and Pilates, and send your kids (gasp) to public school. Trust me, they’re leaving.

Everyone with big incomes and assets and businesses to protect is making plans to leave now. As soon as their homes sell, these refugees will be on the run. If it was a movie it would be called, “ESCAPE FROM CALIFORNIA.”

Don’t take my word for it. Goldman Sachs is already predicting a mass migration of top earners from Manhattan to zero tax states.

Bloomberg reported only days ago that many of Wall Street’s top traders are considering a move to Florida.

ZeroHedge.com reports that New York’s billionaire hedge fund managers are all looking to move to Florida or Texas.

One article quoted a respected CEO of a top accounting firm as saying, “It would be irresponsible if you weren’t thinking of moving.”

California just got hit by an earthquake. But this is far bigger than the San Andreas fault. Anyone making $250,000 or more per year, has to get out of California fast. And New York. And New Jersey. And Illinois.

Thanks to President Trump, this is the opportunity of a lifetime for low tax states like Texas, Florida, Tennessee and Nevada. This is a chance to bring the wealthiest, smartest, most productive people in California and New York and other high tax states to low tax states—like my adopted home state of Nevada. They will spend here, invest here, buy big homes here, pay property taxes to fund schools here, start businesses and create thousands of high-quality jobs here.

This is the opportunity of a lifetime. This is “ESCAPE FROM CALIFORNIA.” They are making plans to leave now. The only question is…

Where will they go?