— Published with Permission of ConservativeHQ.com —

Cutting taxes was supposed to be the easiest part of enacting President Donald Trump’s agenda.

When Trump first announced he was running for president, he drew the most attention for his poignant remarks on immigration and trade. But beneath all of the hyperbole and messaging on populist topics was a wealthy successful businessman/celebrity who touted his name and “know how” as the strongest incentives to vote for him.

To many, making America great again would mean helping more Americans be like Trump (not his personal history, but his take-no-prisoners success story). Over the course of decades, Trump built his family brand by being inexorably linked with premium quality and luxury. If you go to a Trump facility expect to see a lot of gold – and to be treated well.

Encouraging such prosperity would naturally include creating a tax structure that promotes all the good things about economics – consumer saving, investing and yes, spending.

To get more money in people’s pockets, cut their taxes. It’s what the GOP’s all about, right?

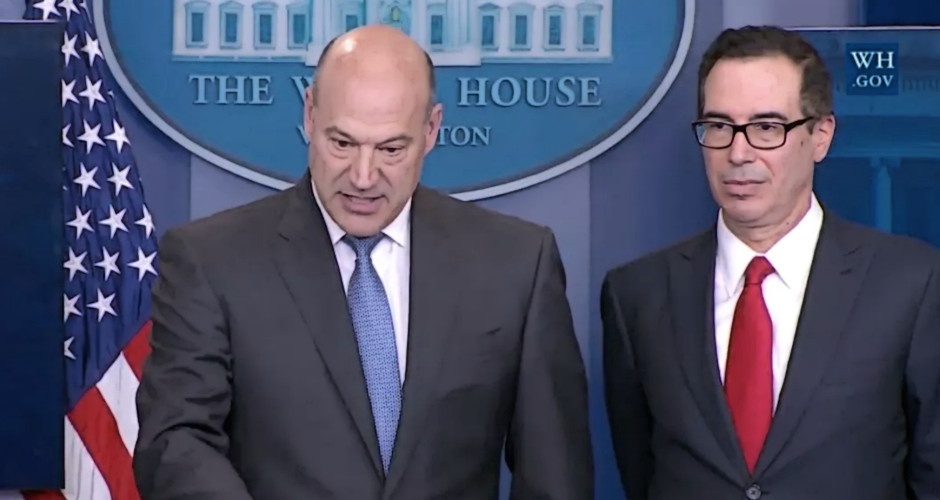

If that’s the case then why is President Trump relying on two of the prominent “West Wing Democrats” — Treasury Secretary Steven Mnuchin and White House economic adviser Gary Cohn — to lead his tax cut mission on Capitol Hill? Needless to say, conservatives are wary of the pair and what they may represent.

Nancy Cook and Rachel Bade of Politico reported, “Neither man has ever worked in or with the legislative branch. They lack inside knowledge about how to navigate Congress at an especially fractious time. Cohn remains a registered Democrat; Mnuchin is a Republican, but he also has a long history of donating to the other party.

“Those Democratic connections have been magnified in the wake of the president’s sudden debt-ceiling deal with Chuck Schumer and Nancy Pelosi, who lead the minority party on Capitol Hill. Now, Republicans throughout Washington are concerned that if the White House can’t craft a plan that unifies the GOP, Trump’s tax writers will once again circumvent Hill Republicans in order to score a win.”

All pro-growth limited government conservatives have good reason to be alarmed. Trump seems to thrive on unpredictability and the possibility he’ll head back over to the Democrats, make another “deal” and leave the country in a hurtful spot is real indeed.

But there are a couple factors working against the pessimists in this regard. First, it’s highly unlikely Trump could get any of the Republican congressional majority to go along with the type of gargantuan pork package that would be necessary to finagle the goodwill of Nancy Pelosi and Chuck Schumer on tax reform.

The Democrats also recognize if they bend too far in favor of giving Trump what he wants that they’re all-but putting themselves out of political play for 2018 and 2020. It shouldn’t be forgotten Trump remains their sworn enemy and just because the two adversary sides agreed on limiting the length of the debt ceiling extension doesn’t mean there’s a sudden new and lasting political détente in Washington.

Far from it, in fact. The Democrats are still desperately hoping to impeach Trump, which would be practically impossible if they don’t retake the House in 2018. In order to capture the House majority, they’ll need to secure their own socialist base and convince enough persuadable voters that Trump is the devil they’ve always made him out to be and his tax ideas will only benefit the rich, wound the elderly, take food out of the mouths of orphans, etc. Everything Democrats have done so far hasn’t born fruit; but they won’t give up.

Second, Trump’s tax ideas will work if implemented. Period.

Ask ten different conservative Republicans for their thoughts on how taxes should be cut and you’ll probably receive ten different answers. But what they’ll all agree on is the basic principle that taxes are too high, economic growth is too sluggish and rate cuts are indispensable to jumpstarting the American economy.

In this sense, all tax reductions are good. Tax cuts that help businesses are probably priority number one, but putting additional emphasis on the demand/consumer side of things isn’t necessarily a bad thought either.

Economist Stephen Moore wrote in the Washington Times this week, “[I]n the aftermath of the Obamacare repeal whiff, enacting the Trump tax cut this year is critical to the expansion. Some of the elation we are seeing in the stock market and business spending is due to the anticipation effect of tax rate cuts before year’s end.

“The lower corporate tax rate would mean trillions of dollars of after-tax stock returns over the next decade and at least some investors are buying ahead of that. Failing to pass a tax cut, could reverse the financial and jobs gains we’ve seen.

“So far seven months into his presidency, love him or hate him, Mr. Trump has shifted the economy and wealth creation into a faster gear. If Republicans — and hopefully pro-business Democrats — can pass a meaningful tax cut this fall — the Trump boom may just be getting started.”

Moore makes it sound like everything rides on Republicans passing a tax cut soon; he’s right and Trump definitely appears to understand this.

The president comprehends he can probably make mistakes in other areas and his base will either forgive him or blame someone else for the failures. When Obamacare repeal fell short a couple months ago there was a pretty visible scapegoat in Mitch McConnell.

If the Republicans fail to cut taxes, however, the economy will not sustain the growth Trump needs to create the kind of presidential legacy he intends to build. Simply put, if growth stalls so will tax revenues. There won’t be the money to build Trump’s border wall, beef up the military, pay for hundreds of billions in infrastructure upgrades and needless to say, deficits will skyrocket.

The resulting malaise could be catastrophic. People may even turn to the Democrats for answers like they did in 2006 and 2008. Not only will America not be great again, it will perhaps be ruined for all time.

Donald Trump can’t let this occur; he won’t let it happen. For this reason alone here’s thinking Trump will put whatever resources and political capital he needs to push through a tax reform package that makes conservatives and Republicans happy. So maybe it isn’t so worrisome after all that Trump ordered Mnuchin and Cohn to head to Congress to foster the negotiations.

The “West Wing Democrats” were just sent to soften up the ground. The real Trump lobbying effort is yet to come. I expect Vice President Mike Pence will be involved with the main effort.

That’s not to say Congress will be overly anxious to move quickly on Trump’s tax plan – or anything else for that matter. The legislative docket is packed and this is typically the time of year lawmakers give up hope of getting real bills written in regular order and simply “punt” the ball further down the road with continuing resolutions.

Susan Ferrechio wrote in the Washington Examiner, “Republicans are punting on the big legislative items on its to-do list this month because they lack agreement to pass anything but short-term extensions of critical federal programs that are set to expire at the end of the month…

“Republicans used a shell 2017 budget to advance a bill to repeal and replace Obamacare. It expires on Sept. 30, leaving the GOP with little choice but to punt until another budget year, or perhaps attach it to the 2018 budget that is supposed to be used for tax reform.”

If this sounds like a copout it’s because it is. The federal reform measures Ferrechio outlined in her article (like privatizing air traffic control in the Federal Aviation Administration) would not be considered hot-button political topics so there’s little excuse for Republican leaders to not make headway in at least bringing legislation forward for a vote.

With Trump’s call for tax reform on the agenda as well as passing a federal budget for 2018 and the looming issues of a DACA extension and a longer-term fix for the debt ceiling, Republicans have an awful lot of work to do ahead. It all boils down to whether the House and Senate leadership can marshal the courage to put topics before the public and vote to get something accomplished.

The Democrats won’t help at all. They’re too busy trying to decide who will take on Trump in 2020 to get serious about anything other than obstruction. Gridlock and failure are their best selling points to Americans if Republicans prove to be too inept to keep their promises.

Passing tax reform should be a no-brainer for Republicans. They run on the issue every election cycle and there’s broad consensus in Congress that rates need to be cut. Donald Trump’s presidency could hinge on what takes place in the next few months; beyond that, the entire republic could be at stake.