Reprinted with permission of Eric Hayes and The Blue Review

How Wall Street made millions off an Idaho investment scheme and the secret settlement that protected the bank

The State of Idaho’s 15-year foray into securities lending may have cost taxpayers more than the $19 million the state has acknowledged, but Idaho Treasurer Ron Crane signed away an opportunity to find out just how much money Idahoans lost — and a chance to get it back — in a confidential settlement agreement in 2012. The settlement resolved a lawsuit the state had filed against KeyBank, according to documents The Blue Review obtained in an investigative project funded by the Idaho Media Initiative.

The state’s 2011 lawsuit, filed in Idaho’s Fourth District Court, asked that KeyBank perform a full audit of the Idaho securities lending program and that the Treasurer’s Office be compensated for whatever losses Idaho suffered as a result of alleged violations of the lending agreement contract, including unauthorized investments and excessive fees.

But Crane’s office settled the suit after a mediation session in Oakland, California, without obtaining a full accounting of the losses, and signed away the right to pursue further legal action against the bank if issues with the program were later discovered.

According to multiple public information requests and interviews, a detailed accounting of Idaho’s losses in the program never took place. The state ended its participation in the program in December 2015, yet state taxpayers have yet to learn the full story of the tens of millions of dollars in illiquid and toxic securities the state purchased and KeyBank managed on its behalf throughout the subprime mortgage crisis and Great Recession.

In addition, a recent whistleblower claim — first reported in the Idaho Statesman — from former deputy treasurer Christopher Priest, an analyst and advisor in the Treasury’s investment division who was terminated in November 2015, alleges that Crane signed the 2012 settlement without adequate legal representation and on terms favorable to the bank. Priest’s tort claims that Crane ignored advice from the Idaho Attorney General’s office to seek outside counsel, hoping that an in-house attorney who lacked experience in securities law would “rubber stamp” an agreement he’d made with the lending agent before mediation hearings.

In addition, Priest alleges that a second Treasury effort to obtain compensation from KeyBank in 2015 was stymied by the 2012 agreement.

Idaho Treasurer Ron Crane, representatives of his office and members of the state’s investment advisory board declined multiple requests for interviews. Neither the Treasurer’s Office nor KeyBank would provide, nor confirm the existence of detailed transaction records that we requested. Crane, when asked why he settled with KeyBank, replied via email that he, “concluded the settlement was the best course of action,” after “careful consideration of the issues in the case and the input from my team.”

A flurry of lawsuits and recent settlements have allowed other states and institutional investors across the nation to reclaim some of the money they lost in risky investments fueled by securities lending programs and mortgage-backed securities swindles. In 2014, The City of Farmington Hills, Michigan, with about 100 other investors, won a $62.5 million settlement from Wells Fargo for, among other things, violating lending agreements by buying high-risk, long-term toxic securities with public monies. BNY-Mellon, with whom Idaho has also banked, agreed to pay out $34 million to settle similar challenges to its securities lending practices on behalf of the South Carolina Treasurer’s Office and $280 million in another suit brought by investors including a union pension fund and a children’s hospital. JPMorgan reached a $150 million settlement in 2012 to end a lawsuit involving its securities lending program.

And credit rating agency Standard & Poor’s settled with the U.S. Justice Department last year for $1.375 billion and admitted knowing — in 2007 — that ratings on mortgage-backed securities were inflated. Idaho received $21.5 million of that settlement, though the state’s involvement in that suit was unrelated to activity in the securities lending program.

Idaho’s short-lived 2011 lawsuit may be the first reported legal action regarding KeyBank’s securities lending program nationwide.

GETTING IDAHO INTO SECURITIES LENDING

Idaho’s history with securities lending goes back to the early 1990s when Crane chaired the Idaho House Business Committee and supported a bill allowing the practice. Soon after he was elected Treasurer in 1998, Crane signed a securities lending agreement(SLA) in which more than $1 billion in assets managed by the Treasury’s Office were entered into a security lending program with Victory Capital Management, at the time a subsidiary of KeyBank. Victory Capital/KeyBank was to manage the funds under the SLA, holding and purchasing securities for the state and then lending them out to investment banks for a hefty fee.

Idaho Treasurer Ron Crane

Treasury officials, in response to public record requests, provided no documentation of a bidding process prior to awarding the contract to Victory in 2000. Priest’s claim against the Treasury alleges multiple examples of Crane’s office obtaining financial advising without going out to bid.

Under SLAs, traders can borrow securities from more conservative investors, like state idle or pension funds, in order to sell them short, betting that the value will decline. Victory handled the transactions in which all of the major investment banks — Goldman, Lehman, Morgan, etc. — borrowed Idaho securities, providing the state cash collateral in the meantime, to be reinvested. The traders then sold the securities and — if successful — bought back more at lower prices, making millions of dollars and eventually returning the original securities loan back to the state.

KeyBank charged Idaho fees to manage the program and also earned a percentage of each loan, likely well under 10 percent, on the other side of the transaction. According to bank statements provided by the Idaho Treasurer’s Office, the state made a fraction of a percent — about 10 basis points or .1 percent — on the loans.

The state also booked gains and losses associated with the securities it owned. To date, the Treasury has reported two net losses, $10.2 million and $8.9 million respectively, associated with liquidating troubled assets.

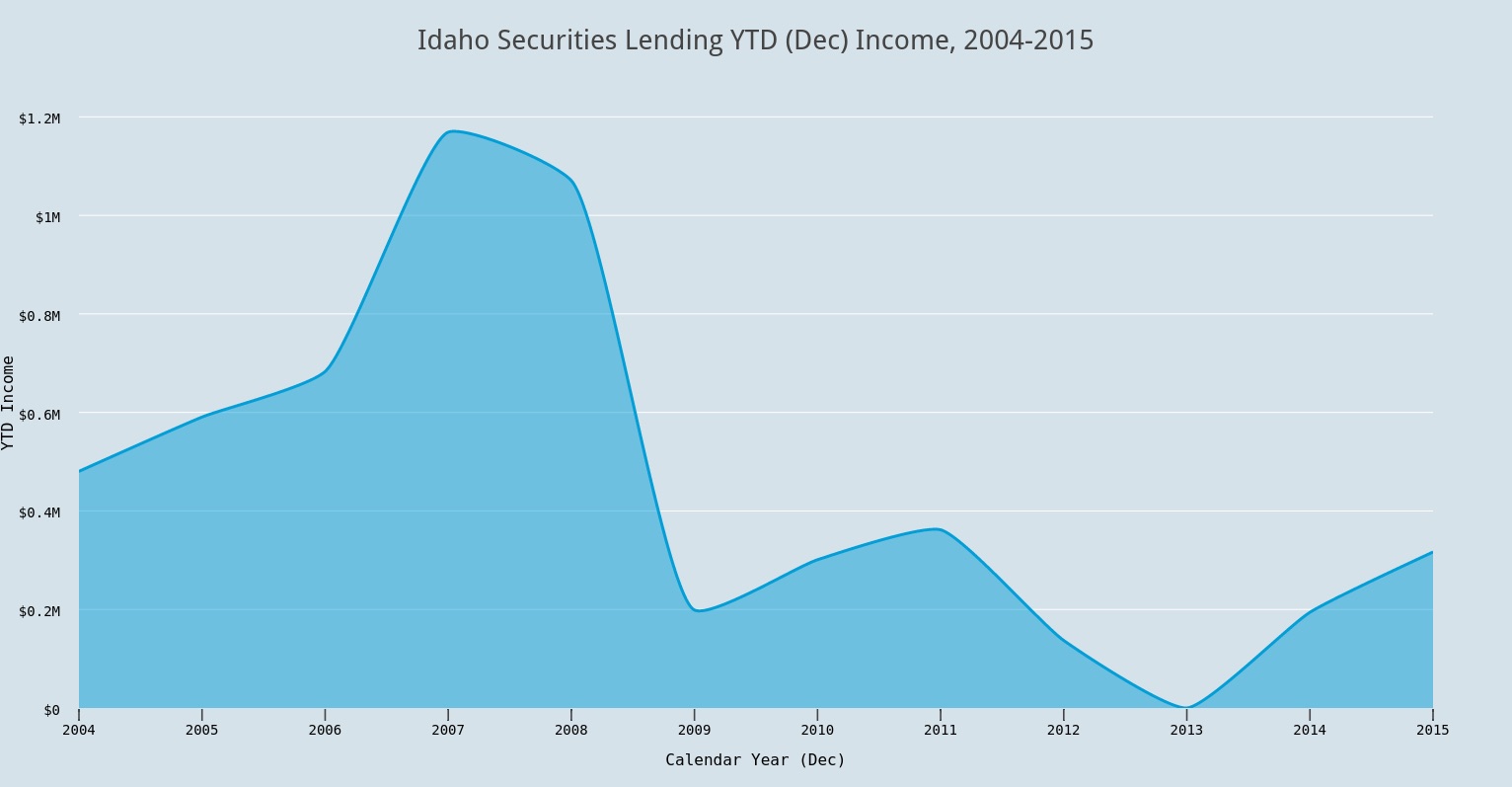

The chart below shows year-to-date earnings on the state’s Idle Pool security loans, reported each December by Key, with a high of $1.2 million in 2007 and a low of zero in 2013. Total income from 2004 to 2015 was $5.7 million. Bank records provided to auditors and in response to our public records requests do not contain transaction level details and thus it is not known if or when the state realized this income.

Idaho securities lending “income” as reported in December KeyBank statements. Statements do not indicate if/when the state realized this income.

Securities lending is a common practice for capitalizing on static asset holdings, but the types of securities being borrowed in 2007, as the recession dawned, included those built on bundles of subprime mortgages and other bad debt and destined to collapse. The state of Idaho would be left with the bill.

IDAHO ATTORNEY GENERAL SUED KEYBANK IN 2011

The lending agreement stipulated that securities purchased by the bank must comply with Idaho’s Prudent Investor Act and included a requirement that asset-backed securities acquired hold a “AAA” rating — investments rating agencies deemed safest — at the time of purchase. The agreement also required that investment maturities not exceed three years and included diversification guidelines that limited the percentage of total holdings the bank could purchase in certain investments. Some of the securities in Idaho’s portfolios held maturities of up to 27 years and securities rated beneath “AAA” were transferred into the state’s Idle Fund portfolio in 2008 and 2009 with State Treasurer’s Office (STO) authorization, according to STO emails. Auditors in the state’s Legislative Services Office found that these securities were improperly reallocated into the state Idle Pool in exchange for cash that exceeded the securities’ fair market value by $20.6 million, and exposed the Idle Pool to unnecessary risk associated with the securities.

The Treasurer’s Office disputed the audit’s finding.

On January 31, 2010 — days before the state notified the bank of violations in the securities lending agreement — the Idle Pool’s total holdings for the securities reallocated in 2008 and 2009 held an approximate combined unrealized loss value of $51.6 million.

The Idaho Attorney General’s office filed a formal complaint against Key on April 22, 2011, alleging that the bank had violated the Securities Lending Agreement and Idaho law by investing in unauthorized securities on behalf of the Idaho Treasury and charging the state unauthorized fees. The suit named the State of Idaho and the Office of the State Treasurer as plaintiffs, and Key Trust Company of Ohio as defendant.

In the lawsuit, the state demanded that KeyBank audit its records for the term of the agreement and that the bank provide a full accounting of all investments made with money received from the Treasurer. The lawsuit demanded that the bank “make the Idaho Treasurer whole” for all losses resulting from investments not permitted by the state, with interest at the statutory rate. The state also demanded that the bank audit all program fees and reimburse the Treasury for charges that exceeded the limits of the lending contract.

The lawsuit was quietly settled a year and a half later after a mediation session in Oakland.

ASSET TROUBLES BEGIN

Two securities in the lending program, Cheyne Finance and Stanfield Victoria, were first downgraded by Moody’s and Standard & Poor’s in late 2007. By Jan 1, 2008, those securities had been assigned the lowest possible rating by both rating agencies. Four additional securities in the program (issued by Goldman Sachs and Morgan Stanley) had been downgraded by Moody’s in March 2009. Those four securities all held maturity rates that exceeded three years when they were purchased in 2007.

By the time the state notified the bank to alleged breaches of the lending agreement’s terms, in December 2010, at least six securities in a portfolio representing the interests of state taxpayers (the state’s Idle Pool, which is comprised of assets in the state’s General Fund not currently in use) had been rated below AAA or had maturities exceeding the guidelines of the agreement.

In a return letter from a KeyBank attorney, the bank denied that it had breached any contracts and claimed that the Idaho Treasurer’s Office had approved investments referenced in the breaches.

Originally, two portfolios within the state’s lending program shared the troubled securities. State audit reports and media accounts have already discussed the controversial transfer of funds between a local government portfolio and the state Idle Pool, a move the Treasurer’s office has said was designed to protect the credit rating of the local government funds.

Treasury emails attribute the idea of restructuring the portfolios to agents from Standard & Poor’s — the agency contracted by the Treasurer’s Office to rate the local government investment pool (LGIP). In an August 4, 2008 email to the state’s lending agent at KeyBank, Liza Carberry, the Treasury’s investment manager at the time, described a meeting with Standard & Poor’s — her contact there was Peter Rizzo, a senior director for financial institutions ratings — and “an idea they presented regarding the SIV LGIP exposure,” and asked the lending agent for “a visit.”

On the morning of August 6, Carberry sent an email to Treasurer Crane asking to be advised whether or not to move the troubled securities (including Cheyne Financial, the first of the SIV’s (Structured Investment Vehicles) to fail as the financial crisis began) into the state Idle Pool portfolio.

In the email, Carberry wrote that she had contacted state auditors and posed a hypothetical question as to whether transferring the assets between the local and state pools would be legal. Carberry wrote that the auditors responded that no GASB [Government Accounting Standards Board] requirements or guidelines existed on the matter, but that they “thought the outright buy and sale had a better document trail.” Carberry also wrote that she’d discussed the matter with the lending agent and that KeyBank’s legal team “seems to think it is okay — that in fact many regulators are asking the big banks to do this very thing which is probably what prompted S&P to recommend it to us.”

In the email, Carberry lists the value of the troubled assets at $55.2 million – a value auditors determined to be $8.7 million higher than their market value at the time.

Later that afternoon, Treasurer Crane wrote an email to Carberry authorizing the transfers. In that email, the Treasurer conceded that he didn’t understand the transaction he was authorizing:

“Thank you for the update. I will follow your lead on this one as it is too technical for me. However, I do think our rating with S&P is more important than any investment vehicle we are using… so if they suggesting [sic] a change (i.e. the move) then it is probably a good idea to follow their suggestion.”

After receiving authorization from the treasurer, Carberry directed the lending agent at KeyBank to move three securities out of the LGIP portfolio to the Idle portfolio “at current market valuations,” — though the values provided to the lending agent, representing the original costs, exceeded fair-market value at the time by $8.7 million.

An email sent by the lending agent later that day described the transaction ordered by the Treasurer’s Office as a purchase of the securities by the Idle pool at original cost (rather than market value).

Those securities were Stanfield Victoria, Cheyne Finance and Liberty Lighthouse — all of which were rated beneath AAA at the time of the transfer. Treasury emails also reveal that the state and the lending agent restructured the lending program to prevent another pool in the lending program, the Diversified Bond Fund, from “exposure” to the securities and “to get them [a likely reference to S&P] off your [the STO’s] back,” according to another August 7 email from the lending agent at Victory, Bill Allen.

SECOND ROUND OF TRANSFERS APPROVED IN 2009

Four additional securities rated below AAA were transferred into the Idle Pool in 2009. Again, the Treasurer’s Office had been notified of an oncoming credit downgrade for the LGIP before the transfer took place. On July 28, 2009, KeyBank sent an email to Carberry asking if the Treasurer wanted to move unspecified assets in the agreement, and commented: “in this environment, I would hate to see any of your investors needlessly panic due to another major ratings move.”

The next day, KeyBank sent an email confirming that the four assets had been moved from the LGIP to the Idle Portfolio, as per the office’s instructions. The prices listed in the email exceeded the fair-market value of the securities by $11.9 million (according to market prices listed on monthly statements). The assets listed in that email were the four mortgage-backed securities that would later be named in the 2012 settlement agreement.

After the second round of transfers were authorized, state taxpayers were holding over $120 million worth of risky securities rated beneath “AAA” by either Moody’s or Standard & Poor’s that accounted for approximately $58.8 million in unrealized losses while the LGIP’s troubled securities holdings and unrealized losses were decreased to nearly zero.

While KeyBank assured the STO that they “continue to expect full return of principal,” — and the Treasurer’s Office has claimed it “did not uncover any facts discrediting this conclusion in its own review of the matter”— documents in the audit workpapers suggest that by the time the transfers were authorized, rating agencies and media reports had identified significant troubles in the dire U.S. housing market.

By June 30, 2013 the LGIP’s securities lending assets had been completely liquidated. The LGIP’s exit from the program left the Idle Pool holding all of the lending program’s risks and unrealized losses.

THE OAKLAND SETTLEMENT TALKS

The terms of the settlement were formalized during a mediation hearing held in Oakland in February 2012. According to a draft of the settlement agreement Treasurer Crane signed on September 18, 2012, the parties agreed “to work cooperatively to liquidate” four securities in the lending program, with KeyBank agreeing to bear 22.5 percent of realized losses incurred during liquidation.

A limit on the bank’s contribution to the state was set at $3.5 million. The state’s requests for a full audit of the lending program and fees charged by the bank weren’t mentioned in the settlement.

The state agreed to dismiss the lawsuit with prejudice — meaning it can’t be reopened if new facts about the program surface — and agreed to release KeyBank from any and all claims and potential claims arising out Idaho’s accounts in the lending agreement. The state agreed to bear its own legal costs and the settlement was made “confidential” to the maximum extent permitted by law — with the stipulation that the bank would be notified in the event that documents connected to the legal action were asked for in public records requests.

Priest’s pending wrongful termination lawsuit alleges that Crane admitted to him that the state should have retained the expertise of a securities lawyer prior to settling with KeyBank. The tort also claims that Crane had agreed privately, and prior to the settlement, with Victory Capital investment manager Bill Allen to “resolve the matter,” and that Crane ignored advice from the Attorney General’s office to seek external counsel because he hoped that an in-house attorney inexperienced in securities law would “rubber stamp” the agreement he reached with Allen.

The securities named in the agreement were four home equity trusts issued by Goldman Sachs and Morgan Stanley that had been transferred into the Idle Pool portfolio in 2009.

Emails between the Attorney General’s office and KeyBank show that the bank’s attorneys pushed for the mediation session to take place in Napa, California. The AG’s office was apparently not swayed by the bank’s argument that the costs of attending a mediation hearing in Napa would be more cost effective than a meeting in Oakland.

But the bigger costs to the state have yet to be tallied.