Idaho enjoys a reputation as a ‘conservative’ state due primarily to the Republican supermajority in the state legislature, but despite the commonality of the belief, the reality is far different.

Yes, Idaho has less restrictive gun laws than many other states (even though there are still several problems to be resolved), but when it comes to the state’s tax climate, it pales in comparison to its neighbors. Let’s examine a few key facts.

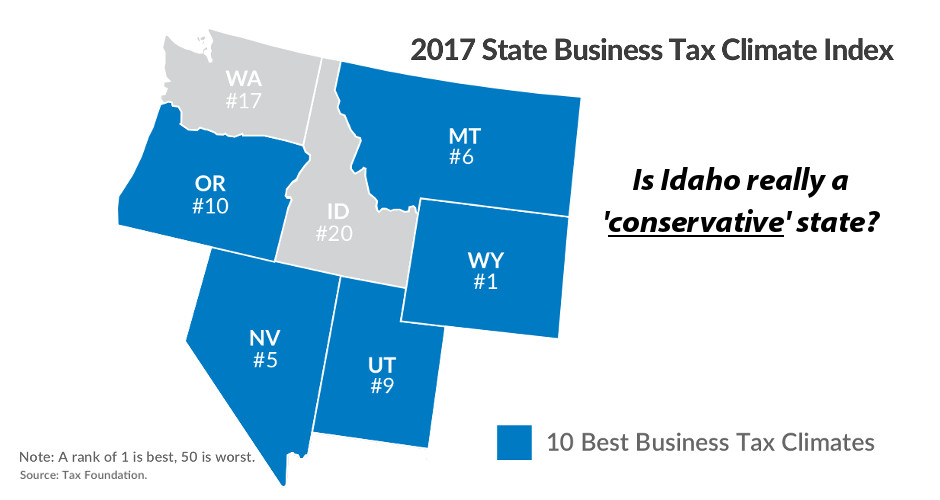

The non-profit, non-partisan Tax Foundation’s 2017 State Business Tax Climate Index lists Idaho’s overall rank at 20 out of 50 (hardly a stellar ranking), but where the problem really comes into focus is when that rank is compared to Idaho’s closest neighbors. Wyoming ranks number 1, Nevada at number 5, Montana at number 6, Utah at number 9, Oregon at number 10, and Washington at number 17.

For those keeping score, six out of six of the states surrounding Idaho have a better business tax climate than does Idaho. Is it any wonder that talented young people and entrepreneurs are fleeing the state for greener pastures?

It’s not just the business tax climate, though. It’s a similar story for individuals. Three of Idaho’s six neighbors have no income tax (Wyoming, Nevada, and Washington) and two of them have no sales tax (Montana and Oregon.) Only Utah has both an income tax and a sales tax like Idaho, but Utah’s personal income tax is a flat 5 percent compared to Idaho’s 7.4 percent tax rate on all income over $10,905.

Are there any bright spots? Idaho used to have a fairly competitive gas tax rate, but thanks to the late-night tax increase spree during the final hours of the 2015 legislative session, that advantage too has largely disappeared. Idaho’s gas tax rate of $.33 cents per gallon ($.32 tax and $.01 ‘petroleum transfer fee’) is higher than Wyoming, Montana, Utah, and Oregon; similar to Nevada (whose rates vary by county); and lower than Washington—who is second only to Pennsylvania in having the nation’s highest gas taxes.

And to top it off, Idaho’s Gov. Butch Otter recently vetoed a bill passed by large majorities in both legislative chambers to repeal the state’s sales tax on groceries, citing the supposed “potential for imminent financial need too great for the small amount of tax relief it would provide.” In other words, he believes the state government needs your money more than you do!

Is Idaho really conservative? Only if you are referring to ‘conserving’ more of YOUR money in the state’s coffers. The state’s spending increases every year even as individuals are expected to make do with less in order to feed the government’s insatiable appetite.

Unless Idahoans start actively saying “you’re fired” to every politician who supports increasing taxes and spending, Idaho’s status as a conservative state will remain a misconception entertained only by those who don’t have to live under its crushing tax burden.